doordash quarterly taxes reddit

The federal tax rate is sitting at 153 as of 2021 and the IRS deducts 0575 per mile. If you made less than 600 you are still responsible for paying taxes and filling out a 1099-NEC.

A Beginner S Guide To Filing Doordash Taxes 4 Steps

If you dont you could have a huge tax bi.

. Thats what I use as a fast easy estimate of my taxable income. You maybe dont need to. The spreadsheet will automatically track your average hourly pay and your average cost of fuel.

If you have any questions about what to report on your taxes you should consult with a tax professional. Subtract 56 cents per mile that you recorded on your mileage log 2021 tax year 585 for 2022. The Doordash Reddit is full of spot-on memes.

Do Instacart Shipt Postmates DoorDash or other platforms take out taxes. So knowing that I quit wasting my time calculating and just send the IRS 20 of the gross income each quarter. What are the quarterly taxes for Grubhub Doordash Uber Eats Delivery Drivers.

I wonder if all the third party stuff is part of why Doordash 1099 forms were a mess. I have a w2 job and DD is just a side thing. If you earn more than 400 as a freelancer you must pay self-employed taxes.

This calculator will have you do this. Plan ahead to avoid a surprise tax bill when tax season comes. Why should couriers with Grubhub Doordash Uber Eats Postmates and others even pay attention to quarterly tax estimates.

Then I adjust it at end of year to more or less miles as needed. If you drive for postmates doordash or any other courier service you need to pay estimated taxes on your income. DoorDash does not take out withholding tax for you.

We hope you found some helpful advice in some of our favorite DD tips from Reddit. If you do this full time and are actually making money at it you probably want to pay attention to it. Some end up believing that it means that these are taxes in addition to your year end taxes.

Please note that DoorDash will typically send. Last year on 57000 income betweeen DoorDash and postmates I paid 390 in taxes. I dont want to go down the rabbit hole too much about taxes.

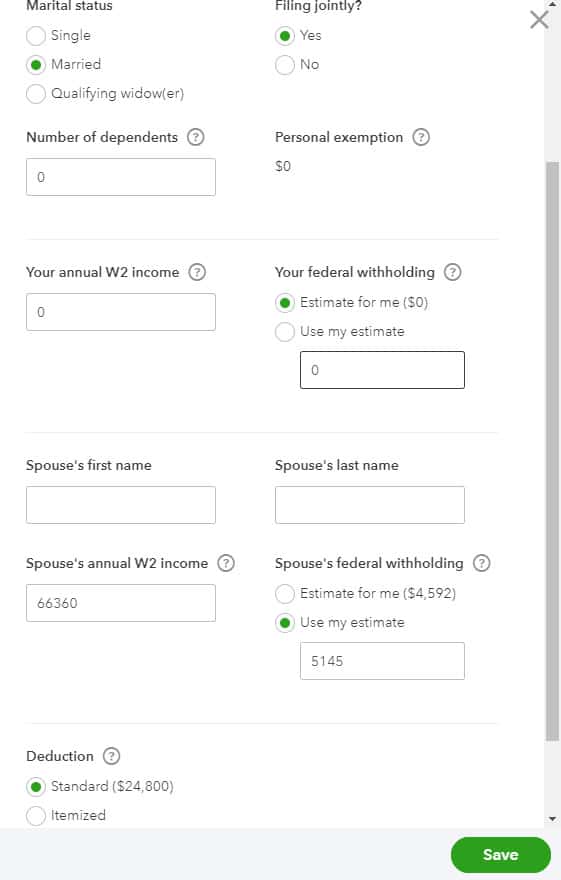

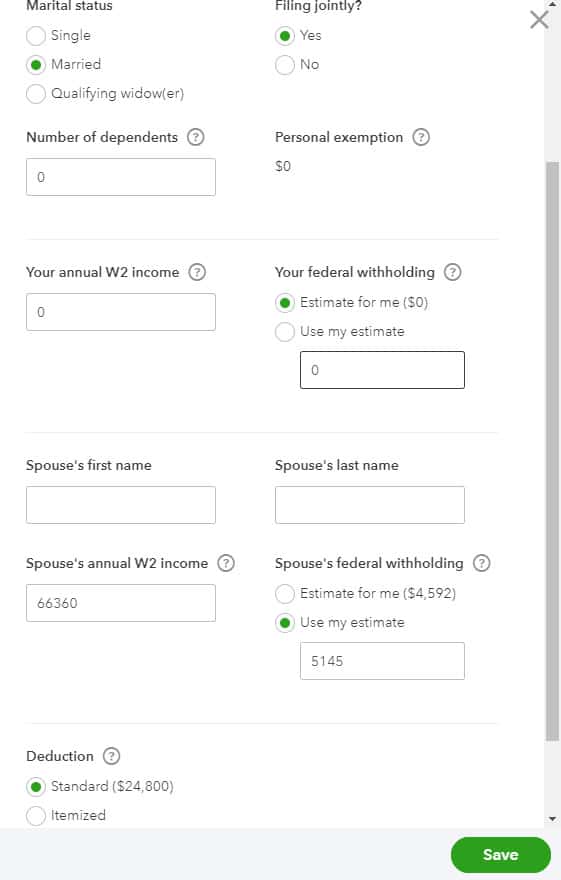

Luckily for us the federal tax rate is only 153. In order to track your estimated quarterly taxes using the IRS cost per mile method update the highlighted cells shown below. Try the App Get the best DoorDash experience with live order tracking.

As an independent contractor you are responsible for keeping track of your earnings and accurately reporting them in tax filingsDoorDash does not provide a breakdown of your total earnings between base pay tips pay boosts milestones etc. Doordash taxes reddit 2021 home artista doordash taxes reddit 2021. Ended up only owing IRS about 250 so essentially had 1250 in tax returns which is about my usual amount.

It will look like this. That includes social security and Medicare. What are the quarterly taxes for grubhub doordash uber eats delivery drivers.

I save about 25 of my DD earnings in a separate account. Doordash quarterly taxes reddit. Dashers will not have their income withheld by the company to pay for these taxes so youll need to pay them on your own.

Ive been driving for DoorDash since January 2020. Payable would then run tax reports based on Stripes records and Doordashs records. A most excellent meme from uPuzzleheaded-Dog-940.

Gig platforms dont withhold or take out taxes for you. Drivers who make more than 20000 with more than 200 transactions will have to file form 1099-K. DoorDash drivers are expected to file taxes each year like all independent contractors.

Last year made 7k from DD and saved about 1500 hundred for tax purposes. Theres a problem with that caption. Everyone is going to be different.

You will owe income taxes on that money at the regular tax rate. The default answer is yes because you asked about reporting. How Do Taxes Work with DoorDash.

Check out our Top Deductions for DoorDash and our Guide to Quarterly Taxes. As a self-employed person the IRS expects you to send in your estimated taxes on a quarterly basis through these 1040-ES payment vouchers. DoorDash will send you tax form 1099-NEC if you earn more than 600.

This is sometimes also known as quarterly taxes. Dashers should make estimated tax payments each quarter. Thats 12 for income tax and 1530 in self-employment tax.

And 10000 in expenses reduces taxes by 2730. If Dashing is a small portion of your income you may be able to increase your income tax withholding at your day job instead of paying quarterly taxes. If you know how to.

All I do each quarter is send the IRS 20 from my GROSS earnings for that quarter and call it good. I have found that when I calculate my quarterly taxes it always falls between 19 and 23 of my GROSS income for that quarter. To pay your taxes youll generally need to make estimated tax payments.

Those who use the app and make deliveries are considered independent contractors and it was my understanding that we put aside money to pay our taxes at the end of the year until today when I found out that not only do you pay taxes at the end of the year you also have to pay quarterly taxes. There is no such thing as quarterly taxes. Subtract 56 cents per mile that you recorded on your mileage log 2021 tax year 575 for 2020.

The self-employment tax is your Medicare and Social Security tax which totals 1530. Each year tax season kicks off with tax forms that show all the important information from the previous year. Add up all your Doordash Grubhub Uber Eats Instacart and other gig economy income.

That is a phrase that gets tossed around a lot but it creates confusion. When you have to get your information from multiple systems for hundreds of thousands of Dashers it just opens the door to errors. This way i decide how many miles i went a day if you get my drift.

Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year. Im new to this independent contractor business and come from the corporate world so not familiar with the concept of quarterly taxes. To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and.

If you drive your car for your deliveries every mile is worth 56 cents off your taxable income the standard mileage rate for the 2021 tax year it bumps up to 585 per mile in 2022. Incentive payments and driver referral payments. My understanding is that 1099 individuals who anticipate having to pay over 1000 in taxes at the end of the year must pay quarterly taxes in addition to the year-end tax process.

Tax Forms to Use When Filing DoorDash Taxes. Form 1099-NEC reports income you received directly from DoorDash ex.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Quarterly Estimated Tax Calculation R Tax

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

If I M Paying Quarterly Taxes R Tax

What If You Haven T Paid Quarterly Taxes Mybanktracker

The Best Guide To Paying Quarterly Taxes Updated For 2021 Quarterly Taxes Estimated Tax Payments Tax Payment

How Does Doordash Do Taxes Taxestalk Net

How To File Taxes As An Independent Contractors H R Block

New Tax Megathread Because The Other Is Archived Talk Taxes Only Here R Doordash

Makenzie Way 2020 Graduate Of Penn Law Reached Out To Mike Sims President Of Barbri To Get The Answers To H Organizational App Phone Deals Wedding Planning

My Door Dash Spreadsheet Finance Throttle

A Beginner S Guide To Filing Doordash Taxes 4 Steps

My Door Dash Spreadsheet Finance Throttle

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier